Achieve Financial Freedom

Through Passive Real Estate Investments!

Jeffreys Capital

A Miami based real-estate private equity & asset management firm which seeks to grow wealth through value add (under valued and/or undermanaged) multifamily and opportunistic commercial real estate transactions. With a focus on our investment partners, we strive to help accredited investors achieve passive income through quality alternative investment strategies.

The firm repositions properties through operational efficiencies, moderate to extensive renovations and rebranding with a complete rollout of our strategic marketing program.

Three words sum up our core business beliefs.

Value – Integrity – Results

Investment Strategy

Jeffreys Capital’s strategy is to undertake strategic investments that are often complex, which enable the company to create value for our investments. Through thoughtful analysis, strategic structuring and careful execution, Jeffreys Capital invests in opportunistic commercial multifamily properties with clear opportunities to add value and enhance investor returns while simultaneously increasing the desirability of our properties for tenants. Successful real estate investing depends on thorough analysis, not creative forecasts. Our goal is to apply disciplined bottom-up analytical process, sophisticated legal and financial structures, and proactive asset management to ensure value-oriented investment thesis for both the tenants and our partners.

As with any investment there are risks. Our core focus is preservation of capital while maximizing returns and minimizing risk through a clear and focused investment process. Our investors benefit from full transparency with access to all documents inside their own investment portal throughout the process. You’ve worked hard for your money, its time your money works hard for you!

Investors make money multiple ways:

CA$HFLOW

Positive cash flow from rental income is typically distributed to investors quarterly and in lump sum payouts at disposition and/or refinancing when available.

APPRECIATION

Unlike single family homes, a multifamily apartment syndication is a business valued primarily by its Net Operating Income (NOI), not property comps. Through physical and operational improvements, you can increase the value of the property by increasing NOI.

DEPRECIATION

Investors benefit from tax benefits such as accelerated depreciation and cost segregation, possible 1031 exchanges into new projects and tax free return of initial equity.

LEVERAGE

We strive to obtain positive leverage when utilizing a loan for an apartment building when the loan yield is less than the net income yield to increase the potential return of an investment.

At Jeffreys Capital, we recognized a need in the property market where investors didn’t have many options to diversify away from the traditional stock market and money management firms. Stocks are volatile and risky. Stocks don’t offer the same stability, consistency, tax benefits, and leverage that real estate offers. Anyone investing alongside us, shares in ownership benefits without the hassle of managing tenants or repairs. At Jeffreys Capital we believe in the power of relationships.

Investor communications is key and something we pride ourselves on. Our investing partners have full transparency through their secure investors portal. In addition we will host quarterly calls and share property management reports regarding all information on the property. Our partners input is always a valued resource.

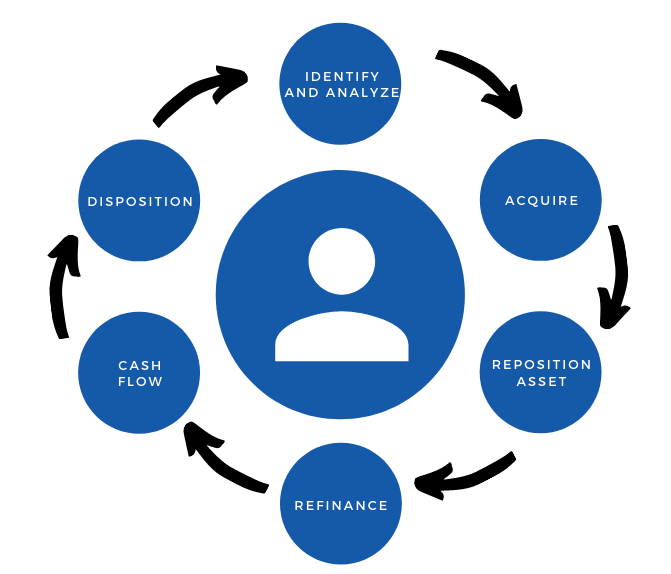

Identify and Analyze

Our strategy is to locate properties through our extensive network and market intelligence in major metropolitan statistical areas, (MSA’s) secondary, and tertiary markets throughout the state of Florida. The target areas we invest in have diverse economies, demonstrate consistent rent growth, low vacancy and a growing local economy to support significant potential for job growth. These carefully selected assets have the most potential moving forward thus minimizing risk.

Acquire

Reposition Asset

Refinance

Cash Flow

Disposition

How It Works

-

Communication

Sign up for our investors club, a community of people just like you, who are looking to grow their wealth and achieve financial freedom. Schedule a call. We’ll take some time to learn more about you and your goals and establish if this type of investment is a suitable fit for you.

-

Deal Review

Participate in our live webinar. Review the deal and documents through your secure investors portal. Submit questions and schedule a call. Review with your accountant and attorney can be made easy through our investment portal.

-

Invest

Invest passively in multifamily real estate syndications (group investments) so you can create passive income and grow your wealth. We do all the rest! You will have full transparency every step of the way.

-

$ Collect $

Getting paid. Depending on the deal structure either monthly or quarterly when available. With every investment, the goal is to build an additional stream of passive income, helping you get one step closer to financial freedom.

reflects fractional ownership interests

Meet the Team

Real Estate News

- Stocks making the biggest moves premarket: Bumble, Hims & Hers Health, Blue Owl, Netskope & more

These are the stocks posting the largest moves in premarket trading.

- Lobster buffet: China’s tech firms feast on OpenClaw as companies race to deploy AI agents

China-based usage of OpenClaw has already topped that of the U.S., while driving demand for Chinese lower-cost AI models.

- Stocks making the biggest moves midday: Oracle, Papa John's, Nebius, Campbell's, Serve Robotics, Cadre and more

These are some of the stocks posting the largest midday moves.

- Stocks making the biggest moves premarket: Oracle, AeroVironment, Nike, CarMax and more

These are the stocks posting the largest moves in premarket trading.

- JPMorgan Chase reins in lending to private credit firms after marking down software loans

JPMorgan's move shows that the biggest U.S. bank by assets wants to get ahead of potential turbulence involving private credit loans to software companies.